BRICS is using BLOCKCHAIN to kill dollar dominance.

First, a short explanation of what BRICS is:

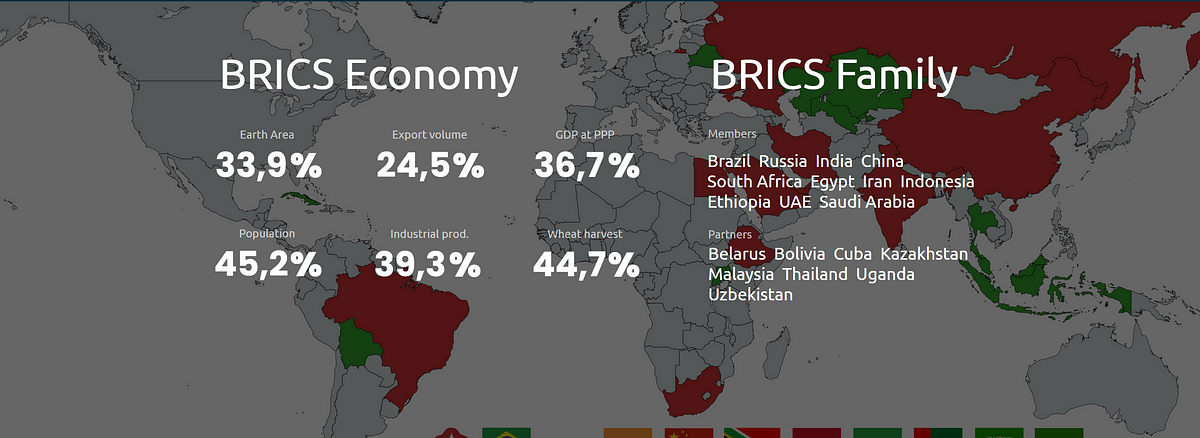

BRICS is an organization comprising Brazil, Russia, India, China, and South Africa. It was formed in 2009. Other members have also joined this organization including: Egypt, Iran, Indonesia, Ethiopia, UAE and Saudi Arabia.

Partners:

Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Thailand, Uganda, Uzbekistan, Algeria, Turkey, Nigeria, Vietnam.

This organization of non-Western countries is working together to:

"promote economic growth, development, and cooperation among member countries, while also advocating for a more equitable and just world order, including reforms to the international financial and political systems"

That's the narrative "by the book."

In reality, they are working to Challenge the dominance of the Western-led order, especially the G7 and institutions like NATO, IMF, and the World Bank.

The G7 is an organization like BRICS but made up of world's largest advanced Western economies: Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. It was formed in 1975.

BRICS has grown significantly since 2009,

the overall GDP of the BRICS countries is 37.4% compared to G7 29.3%. BRICS countries now account for approximately 35% of the world's GDP in terms of purchasing power parity (PPP), while the G7 represents 30%.

In the 2000s, the G7 held over 40% compare to just 8.4% of BRICS member countries in 2000s.

Why does BRICS want to counter dollar dominance?

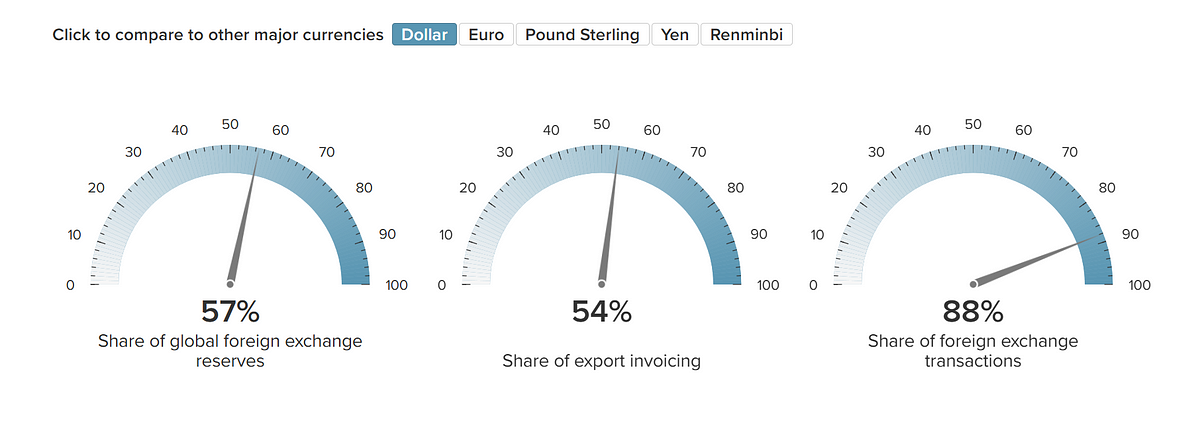

The United States and other Western countries have asserted the dominance over the world through Dollar which is the most widely traded currency & have a strong reserve because of united states economy. As of 2025, 57% of global foreign exchange reserves are held in dollar.

The dollar accounts for 88% of all foreign exchange transactions. So now you know that the dollar dominates the international market. But it's not just the dollar that gives the U.S. its power to dominate, there is one other, SWIFT.

SWIFT (Society for Worldwide Interbank Financial Telecommunications) is a secure messaging network that banks use to communicate and transfer money internationally. Think of it like WhatsApp, but for banks—and far more secure, allowing them to send instructions for transferring funds across borders. While it facilitates the transfers, SWIFT doesn't actually hold or transfer money itself, it's just the communication channel. It was founded in 1973 in Brussels, Belgium.

The U.S. indirectly controls SWIFT due to the dominance of the U.S. dollar in global trade, influencing which countries' banks can be connected to the SWIFT network and which cannot. Not being able to connect with SWIFT will decrease the trust of other countries bank to trade with that particular country leading to massive economic losses for the excluded nation.

Examples of U.S. using its power to remove countries from SWIFT network:

2012 : The U.S. pressured SWIFT to disconnect Iranian banks as part of sanctions related to Iran's nuclear program.

Result: This severely limited Iran's ability to conduct international trade and access foreign currency.

2018: After withdrawing from the Iran nuclear deal (JCPOA), the U.S. again pushed for key Iranian banks (including the Central Bank) to be removed from SWIFT.

Result: Iran's international oil sales and trade dropped drastically.

2022: Following the invasion of Ukraine, the U.S., along with EU allies, forced SWIFT to ban several Russian banks.

Result: Crippled Russia's ability to process cross-border payments. Led Russia to push alternatives like the SPFS (System for Transfer of Financial Messages) and China's CIPS.

North Korea: While North Korea isn't a SWIFT member, U.S. sanctions have blocked countries and financial institutions from engaging with it, essentially isolating it from global banking, similar to SWIFT exclusion.

So now we understand that how America can weaponize Dollar & SWFIT for their profits & geopolitical objectives.

Now we know the reason why BRICS Is Building a financial system on blockchain technology to counter dollar dominance. Let's dive deeper into how they are implementing it.

How is BRICS implementing Blockchain to create a inter-country payment system?

If it's your first time hearing about blockchain then congratulations you will be learning something new and cool today.

Blockchain is the technology behind Bitcoin (poster boy of cryptocurrencies) , Doge (Promoted a lot by ELON MUSK) , TRUMP (MEME Coin Launched by TRUMP) and many more.

Simply put, blockchain technology provides a structure to store data in a way that is :

- Immutable—meaning it cannot be changed once recorded

- Transparent—everyone can view the data

- Anonymous—your identity can remain hidden

- Decentralized—control is distributed among multiple participants, rather than a single centralized entity

BRICS PAY

BRICS Pay is a decentralized payment messaging system designed to facilitate transactions in local currencies among BRICS countries. Developed collaboratively by experts from member nations, it aims to enhance the safety, transparency, and efficiency of international payments. A key component is the Decentralized Cross-border Messaging System (DCMS), which allows participants to manage their own nodes, ensuring resilience against external control or interference. DCMS supports encrypted messaging and can process up to 20,000 messages per second. DCMS can be considered as an alternative to SWIFT.

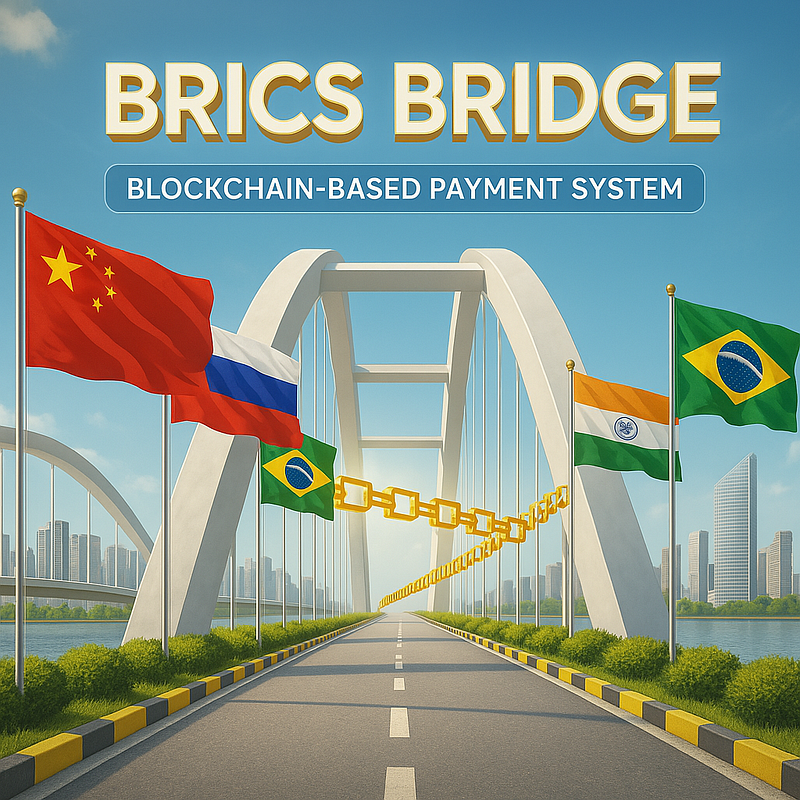

BRICS Bridge

The BRICS Bridge was developed to reduce reliance on the US dollar in international transactions. Right now 88% of international transactions are being done using US Dollar. By leveraging blockchain technology, BRICS Bridge aims to facilitate faster, more secure, and cost-effective cross-border payments using local currencies, thereby minimizing the need for dollar conversions and bypassing traditional systems like SWIFT.

Key Features:

- Blockchain Integration: Utilizes distributed ledger technology to ensure transparent and tamper-proof transactions.

- Local Currency Settlements: Enables direct trade settlements between member countries in their respective national currencies, reducing dependence on the US dollar.

- Cost Efficiency: Aims to lower transaction fees and processing times compared to conventional banking systems.

By implementing BRICS Bridge, member nations seek to enhance financial sovereignty and resilience against external economic pressures, contributing to a gradual shift away from dollar-dominated trade.

BRICS Pay is more focused on integrating and facilitating payments within the BRICS bloc, while BRICS Bridge is a broader initiative to create an independent payment infrastructure that challenges Western-dominated systems like SWIFT. Both are part of the BRICS strategy to enhance economic sovereignty and reduce dependence on the US dollar.

BRICS Pay Consortium

The BRICS Pay Consortium is a collaborative effort by financial, technological, legal, and consulting firms from the BRICS nations to develop and implement the BRICS Pay system. This consortium operates under the principles of a decentralized autonomous organization (DAO), ensuring that it is a network-based entity without a central headquarters. The consortium adheres to the regulations of each country where its members operate, and its membership is not publicly disclosed.

Key Features:

- Decentralized Structure: The consortium is structured as a DAO, which means it operates without a central authority, allowing for decentralized decision-making and management.

- Regulatory Compliance: It adheres to the legal and regulatory frameworks of the countries where its members are based, ensuring compliance with local laws.

- Collaborative Approach: The consortium brings together diverse stakeholders from the BRICS countries to collaborate on developing a unified payment system.

- Technological Focus: The consortium is focused on leveraging advanced technologies like blockchain, to create a secure, efficient, and cost-effective payment system.

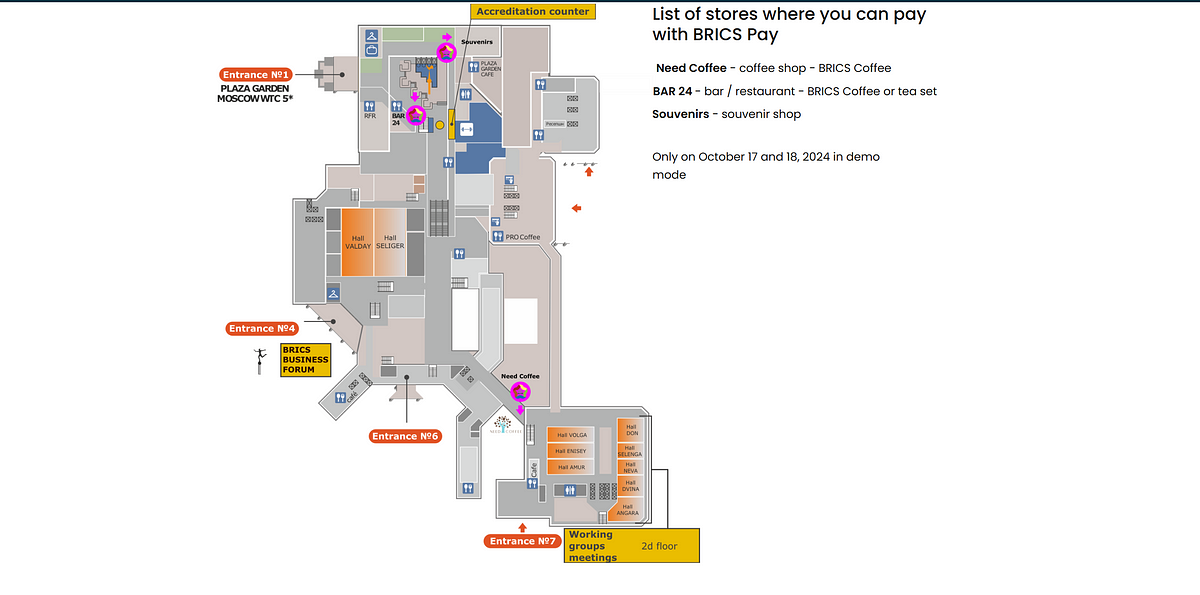

In 2024, participants in Moscow tested BRICS Pay with real‑time QR‑code payments at the World Trade Center. Over 4,000 people used it to make purchases around the WTC (World Trade Center).

All the member and partner countries openly support BRICSPay. After Donald Trump's tariff policies, even more countries, which are not part of BRICS, are showing support, including:

Turkey—Voiced formal interest in partner‑country status and deeper BRICS engagement as it seeks to balance Eastern and Western ties.

Egypt—Identified as a potential beneficiary of trade realignments and began exploring non‑dollar settlement mechanisms amid U.S. tariffs.

Singapore—Examining ways to attract investment and expand manufacturing via alternative payment corridors following tariff‑driven disruptions.

Challenges BRICSPAY Faces

BRICS Pay faces several challenges that could impact its success as a global alternative payment system. Here are some of the key issues:

- ⚠️ Lack of Unified Digital Infrastructure: BRICS countries use different tech stacks, regulations, and banking systems. Integration across nations with varying tech maturity is complex.

- 🌐 Currency Volatility: Settling trades in local currencies (like ruble, rupee, rand) can be unstable due to frequent fluctuations which Creates risks for international merchants and investors.

- 💸 Limited Convertibility of some currencies: Some BRICS currencies (e.g., Chinese yuan, Indian rupee) aren't fully convertible which Hinders seamless cross-border settlements.

- 📊 Low Adoption outside BRICS: Non-member countries are still cautious about leaving the USD ecosystem. Global merchants rely on dollar liquidity and network effects.

- 🏛️Regulatory Barriers: Each country has its own central bank and legal stance on blockchain/crypto, Cross-border compliance is still evolving.

- 🧩Competing National Priorities: China and Russia may lead the push, but other members may prioritize different payment agendas. Political alignment is not always smooth within the bloc.

BRICS nations have been actively working on this payment system since 2019, with significant progress made in recent years. including the unveiling of BRICS Pay during the BRICS Business Forum in Moscow in October 2024.

It's truly inspiring to see countries recognizing the value of technology like blockchain and leveraging its power to improve people's lives. I fully support this initiative and will contribute in any way I can.